- HOME

- Sustainability

- SDGs Initiatives

- Encouragement of Investment Projects for Stimulating the Emergence of "New Industry Creator"

Encouragement of Investment Projects for Stimulating the Emergence of "New Industry Creator"

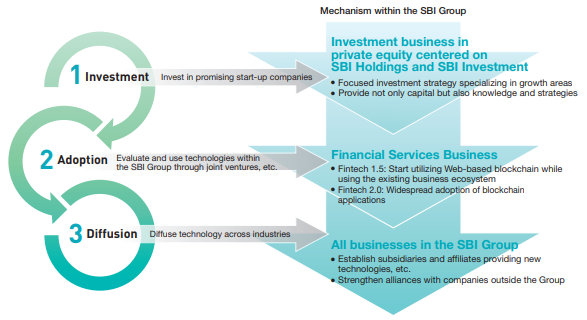

To achieve one of its management philosophies, "New Industry Creator," the SBI Group has positioned the investment business as one of its core businesses, engaging in it since the Group's foundation. The Group has continued to focus its investment in IT, biotechnology, the environment, and energy field. In addition, it has recently been investing intensively in growth fields that will be next-generation core industries, such as fintech, AI (artificial intelligence), and blockchain.

Upon cultivating and developing new business fields, the SBI Group has been not only "investing" aggressively in startups with the above innovative cutting-edge technologies but also "adopting" these technologies within the Group. Thus, the Group has been expanding its business through the incorporation of innovative technologies into itself ahead of others. Further, by taking the step of "diffusing" not only the technologies but also the expertise built up within the Group to our alliance partners, we believe we can benefit to more companies and consumers.

Setting up funds in response to changes in the times and technologies

SBI Investment serves as the core company in the SBI Group's Asset Management Business. It is Japan's leading venture capital business operating and managing venture capital funds, under the management philosophy to become the leader in creating and cultivating core industries of the 21st century as a "New Industry Creator." The company has invested in more than 1,000 companies in Japan and other countries and has brought approx. 180 of them into the society through IPOs, or M&A.

SBI Investment has set up funds by setting major investment sectors in response to changes in the times and technology, with a focus on the IT sector, where technological advancements are especially rapid. In 2000, the company established a venture capital fund that was the largest in Japan at the time (¥150.5 billion in total) contributing to the development of many domestic Internet-related companies. Since then, it has continued to invest in and support companies involved in businesses such as communications infrastructure, mobile communications, smartphones, fintech, AI, and blockchain. In April 2021, the company launched the SBI 4+5 Fund, one of Japan's largest venture capital funds with a total commitment of ¥100 billion, that invests in broad industries such as 5G, IoT, and big data that contribute to the realization of "Society 5.0 for SDGs," as well as robotics, healthcare, infrastructure, food and agriculture to advance "Industry 4.0."